GE Vernova Inc. Common Stock (GEV)

830.34

-4.27 (-0.51%)

NYSE · Last Trade: Feb 21st, 3:09 PM EST

These two stocks could deliver explosive returns in the coming years.

Via The Motley Fool · February 21, 2026

The U.S. Department of Commerce released its highly anticipated Durable Goods Orders report on February 18, 2026, revealing a striking divergence in the American industrial sector. While the headline figure showed a contraction due to the inherent volatility of the aerospace industry, the "core" measures of manufacturing health painted

Via MarketMinute · February 18, 2026

The opening weeks of 2026 have witnessed a tectonic shift in global capital markets, marking what analysts are calling the "Great Sector Rotation." After three years of relentless dominance by artificial intelligence and cloud computing giants, the tide has abruptly turned. Investors are staging a massive exodus from high-multiple Software-as-a-Service

Via MarketMinute · February 17, 2026

GE Vernova and Cameco are evergreen energy plays.

Via The Motley Fool · February 17, 2026

In a move that significantly recalibrates the geopolitical and economic landscape of the Pacific, the United States and Taiwan finalized a sweeping trade agreement on February 13, 2026. This "U.S.–Taiwan Agreement on Reciprocal Trade" (ART) marks a transformative shift in bilateral relations, centering on a massive exchange: the

Via MarketMinute · February 17, 2026

NEW YORK — In a resounding signal that the American industrial heartland has finally shaken off its post-pandemic lethargy, the U.S. manufacturing sector roared back into expansion territory in January 2026. The Institute for Supply Management (ISM) reported on February 2nd that its Manufacturing PMI rose to 52.6 last

Via MarketMinute · February 16, 2026

GE Vernova’s 28.4% return over the past six months has outpaced the S&P 500 by 22.5%, and its stock price has climbed to $802.45 per share. This was partly due to its solid quarterly results, and the performance may have investors wondering how to approach the situation.

Via StockStory · February 15, 2026

There's no let-up yet in spending on AI and building out data centers to support its growth, and that's great news for this stock.

Via The Motley Fool · February 11, 2026

The global revival of nuclear energy has put NuScale Power in the spotlight.

Via The Motley Fool · February 11, 2026

Via MarketBeat · February 11, 2026

These S&P500 stocks are moving in today's pre-market sessionchartmill.com

Via Chartmill · February 11, 2026

Even if they go mostly unnoticed, industrial businesses are the backbone of our country. But their prominence also brings high exposure to the ups and downs of economic cycles.

Luckily, the tide is turning in their favor as the industry’s 27% return over the past six months has topped the S&P 500 by 17.9 percentage points.

Via StockStory · February 10, 2026

This nuclear energy ETF isn't grabbing many headlines, but it's beating its rivals, cementing its hidden gem status.

Via The Motley Fool · February 8, 2026

Artificial intelligence (AI) application-led demand is driving soaring power orders at the General Electric spinoff.

Via The Motley Fool · February 7, 2026

In a stunning reversal of a year-long industrial malaise, the U.S. manufacturing sector roared back to life this week as the Institute for Supply Management (ISM) released its latest Purchasing Managers' Index (PMI) data. The report, made public on February 6, 2026, showed the manufacturing PMI climbing to a

Via MarketMinute · February 6, 2026

A number of stocks jumped in the afternoon session after the broader market rebounded from a tech-driven sell-off, with investors taking the opportunity to buy stocks at lower prices.

Via StockStory · February 6, 2026

The AI infrastructure play is set to benefit from a massive ramp in hyperscaler spending.

Via The Motley Fool · February 6, 2026

As of February 6, 2026, the dominant narrative on Wall Street has shifted from the virtual to the tangible. After years of dominance by Silicon Valley’s software giants, a powerful "Great Rotation" is underway, with institutional capital aggressively migrating toward the backbone of the physical economy. Investors are increasingly

Via MarketMinute · February 6, 2026

GE Vernova's growth cycle is only getting started.

Via The Motley Fool · February 6, 2026

Whether you see them or not, industrials businesses play a crucial part in our daily activities. But their prominence also brings high exposure to the ups and downs of economic cycles.

Luckily, the tide is turning in their favor as the industry’s 21% return over the past six months has topped the S&P 500 by 12.5 percentage points.

Via StockStory · February 5, 2026

Meta Platforms (NASDAQ: META) has fundamentally rewritten the playbook for Big Tech growth, pivoting from its celebrated "Year of Efficiency" into a massive "Scaling Phase" defined by unprecedented capital expenditure. Following a blockbuster Q4 2025 earnings report that saw revenue climb 24% to $59.9 billion, the company stunned Wall

Via MarketMinute · February 5, 2026

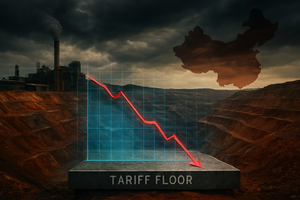

In a move that has sent shockwaves through global commodities markets, rare earth and critical materials stocks suffered a sharp sell-off this week following the U.S. administration's announcement of a "tariff floor" policy. The new regulatory framework, unveiled by Vice President J.D. Vance during a Critical Minerals Ministerial

Via MarketMinute · February 5, 2026

Buying energy stocks is the new pick-and-shovel strategy for AI investors.

Via The Motley Fool · February 5, 2026

GE's rapidly growing energy spinoff has a bright future.

Via The Motley Fool · February 4, 2026

GE Vernova could benefit from soaring long-term demand for electricity and renewable energy -- and not just from data centers.

Via The Motley Fool · February 4, 2026