GE Vernova Inc. Common Stock (GEV)

823.67

+0.00 (0.00%)

NYSE · Last Trade: Feb 12th, 4:57 AM EST

Detailed Quote

| Previous Close | 823.67 |

|---|---|

| Open | - |

| Bid | 828.00 |

| Ask | 834.80 |

| Day's Range | N/A - N/A |

| 52 Week Range | 252.25 - 834.00 |

| Volume | 837 |

| Market Cap | 227.33B |

| PE Ratio (TTM) | 46.56 |

| EPS (TTM) | 17.7 |

| Dividend & Yield | 2.000 (0.24%) |

| 1 Month Average Volume | 3,463,495 |

Chart

News & Press Releases

There's no let-up yet in spending on AI and building out data centers to support its growth, and that's great news for this stock.

Via The Motley Fool · February 11, 2026

The global revival of nuclear energy has put NuScale Power in the spotlight.

Via The Motley Fool · February 11, 2026

Via MarketBeat · February 11, 2026

These S&P500 stocks are moving in today's pre-market sessionchartmill.com

Via Chartmill · February 11, 2026

Even if they go mostly unnoticed, industrial businesses are the backbone of our country. But their prominence also brings high exposure to the ups and downs of economic cycles.

Luckily, the tide is turning in their favor as the industry’s 27% return over the past six months has topped the S&P 500 by 17.9 percentage points.

Via StockStory · February 10, 2026

This nuclear energy ETF isn't grabbing many headlines, but it's beating its rivals, cementing its hidden gem status.

Via The Motley Fool · February 8, 2026

Artificial intelligence (AI) application-led demand is driving soaring power orders at the General Electric spinoff.

Via The Motley Fool · February 7, 2026

In a stunning reversal of a year-long industrial malaise, the U.S. manufacturing sector roared back to life this week as the Institute for Supply Management (ISM) released its latest Purchasing Managers' Index (PMI) data. The report, made public on February 6, 2026, showed the manufacturing PMI climbing to a

Via MarketMinute · February 6, 2026

A number of stocks jumped in the afternoon session after the broader market rebounded from a tech-driven sell-off, with investors taking the opportunity to buy stocks at lower prices.

Via StockStory · February 6, 2026

The AI infrastructure play is set to benefit from a massive ramp in hyperscaler spending.

Via The Motley Fool · February 6, 2026

As of February 6, 2026, the dominant narrative on Wall Street has shifted from the virtual to the tangible. After years of dominance by Silicon Valley’s software giants, a powerful "Great Rotation" is underway, with institutional capital aggressively migrating toward the backbone of the physical economy. Investors are increasingly

Via MarketMinute · February 6, 2026

GE Vernova's growth cycle is only getting started.

Via The Motley Fool · February 6, 2026

Whether you see them or not, industrials businesses play a crucial part in our daily activities. But their prominence also brings high exposure to the ups and downs of economic cycles.

Luckily, the tide is turning in their favor as the industry’s 21% return over the past six months has topped the S&P 500 by 12.5 percentage points.

Via StockStory · February 5, 2026

Meta Platforms (NASDAQ: META) has fundamentally rewritten the playbook for Big Tech growth, pivoting from its celebrated "Year of Efficiency" into a massive "Scaling Phase" defined by unprecedented capital expenditure. Following a blockbuster Q4 2025 earnings report that saw revenue climb 24% to $59.9 billion, the company stunned Wall

Via MarketMinute · February 5, 2026

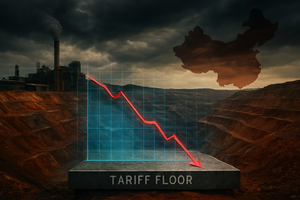

In a move that has sent shockwaves through global commodities markets, rare earth and critical materials stocks suffered a sharp sell-off this week following the U.S. administration's announcement of a "tariff floor" policy. The new regulatory framework, unveiled by Vice President J.D. Vance during a Critical Minerals Ministerial

Via MarketMinute · February 5, 2026

Buying energy stocks is the new pick-and-shovel strategy for AI investors.

Via The Motley Fool · February 5, 2026

GE Vernova (NYSE: GEV) is pleased to announce the closing of its previously announced registered public offering of Senior Notes.

By GE Vernova Inc. · Via Business Wire · February 4, 2026

GE's rapidly growing energy spinoff has a bright future.

Via The Motley Fool · February 4, 2026

GE Vernova could benefit from soaring long-term demand for electricity and renewable energy -- and not just from data centers.

Via The Motley Fool · February 4, 2026

GE Vernova’s fourth quarter was marked by solid top-line growth, with revenue and GAAP profit both surpassing Wall Street expectations. Management pointed to robust new gas contracts and record Electrification orders as core drivers, while acknowledging challenges related to the U.S. government’s halt of offshore wind activity. CEO Scott Strazik highlighted a 25% increase in total backlog, driven by strong demand in Power and Electrification segments, and emphasized the company’s progress in expanding high-margin service agreements. However, the abrupt stop-work order on the Vineyard Wind project required the company to accrue additional costs, impacting segment profitability.

Via StockStory · February 4, 2026

This company's end markets are firing on all cylinders right now.

Via The Motley Fool · February 3, 2026

GE Vernova Inc. (NYSE: GEV) today announced it has completed the acquisition of the remaining 50% stake of Prolec GE, its former unconsolidated joint venture with Xignux (“Prolec GE”). The transaction, originally announced in October 2025, closed following receipt of all required regulatory approvals, for a purchase price of $5.275 billion, funded as previously disclosed with an equal mix of cash and debt.

By GE Vernova Inc. · Via Business Wire · February 2, 2026

In a landmark move that redraws the geopolitical map of the digital age, the United States and Japan have finalized the Technology Prosperity Deal (TPD), a staggering $550 billion agreement designed to create a unified “AI industrial base.” Announced in mid-2025 and moving into full-scale deployment as of February 2, 2026, the pact represents the [...]

Via TokenRing AI · February 2, 2026

The announcement, delivered from the East Room alongside the CEOs of the nation's largest industrial titans, marks a fundamental shift in U.S. economic policy. By treating critical minerals with the same strategic gravity as crude oil, the administration intends to provide a "sovereign shock absorber" for domestic manufacturers. For

Via MarketMinute · February 2, 2026

In a definitive display of market dominance, Meta Platforms (NASDAQ:META) saw its shares surge over 7% in early trading on February 2, 2026, following a blowout fourth-quarter earnings report that shattered analyst expectations. The social media titan, which has successfully rebranded itself as an industrial-scale AI powerhouse, reported a

Via MarketMinute · February 2, 2026