Meta Platforms, Inc. - Class A Common Stock (META)

716.50

-21.81 (-2.95%)

NASDAQ · Last Trade: Jan 31st, 4:47 PM EST

Detailed Quote

| Previous Close | 738.31 |

|---|---|

| Open | 727.50 |

| Bid | 714.60 |

| Ask | 715.00 |

| Day's Range | 713.59 - 732.17 |

| 52 Week Range | 479.80 - 796.25 |

| Volume | 23,760,557 |

| Market Cap | 2.06T |

| PE Ratio (TTM) | 43.82 |

| EPS (TTM) | 16.4 |

| Dividend & Yield | 2.100 (0.29%) |

| 1 Month Average Volume | 17,681,845 |

Chart

About Meta Platforms, Inc. - Class A Common Stock (META)

Meta Platforms Inc is a technology company that focuses on building and connecting social media platforms and virtual experiences. It is best known for its flagship products, which include Facebook, Instagram, and WhatsApp, providing users with a space to communicate, share content, and engage with diverse communities. The company is also heavily invested in the development of augmented reality and virtual reality technologies, aiming to create immersive environments and enhance social interaction in the metaverse. Through its various platforms and initiatives, Meta seeks to empower individuals and businesses while fostering new ways for people to connect and collaborate. Read More

News & Press Releases

Meta Platforms continues to be a winner, but gets little respect from the market.

Via The Motley Fool · January 31, 2026

MarketBeat Week in Review – 01/26 - 01/30marketbeat.com

Via MarketBeat · January 31, 2026

Thiel's latest move suggests a change in AI strategy.

Via The Motley Fool · January 31, 2026

There's a lot for investors to like about Meta in 2026.

Via The Motley Fool · January 31, 2026

The Vanguard Information Technology ETF is missing some key long-term pieces.

Via The Motley Fool · January 31, 2026

Apple's revenue growth is accelerating again, while Meta's outlook is strong but clouded by heavy spending.

Via The Motley Fool · January 30, 2026

Meta could soon be the world's largest advertising business.

Via The Motley Fool · January 30, 2026

Software was eating the world in the early 2010s. Is AI eating software today?

Via The Motley Fool · January 30, 2026

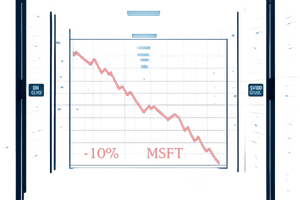

In a jarring reminder that even the world’s most valuable companies are not immune to the gravity of market expectations, Microsoft Corp. (NASDAQ:MSFT) saw its shares plunge nearly 10% following its Q2 FY2026 earnings report on January 28, 2026. Despite beating top and bottom-line estimates with total revenue

Via MarketMinute · January 30, 2026

MENLO PARK, CA — In a resounding validation of its aggressive pivot toward artificial intelligence, Meta Platforms (NASDAQ:META) saw its stock price skyrocket by 9% in late January 2026. The surge followed a blowout fourth-quarter earnings report that silenced critics of the company’s massive capital expenditure and established the

Via MarketMinute · January 30, 2026

Apple Inc. (NASDAQ: AAPL) delivered a commanding performance in its fiscal first-quarter earnings report on January 29, 2026, shattering revenue and profit records on the back of explosive demand for the iPhone 17. Despite exceeding analyst expectations across nearly every major metric, the tech giant saw its stock price decline

Via MarketMinute · January 30, 2026

NextEra Energy combines utility stock stability with renewable energy upside.

Via The Motley Fool · January 30, 2026

The U.S. bond market is witnessing a significant recalibration as the 10-Year Treasury yield climbed to a pivotal 4.24% today, January 30, 2026. This surge, fueled by a combination of persistent "low-grade fever" inflation and heightened geopolitical friction, was further solidified by President Donald Trump’s official nomination

Via MarketMinute · January 30, 2026

The final week of January 2026 has been defined by a return to "tariff diplomacy" and a surreal geopolitical standoff over the world’s largest island, sending ripples of volatility through the S&P 500. President Trump’s dual-track strategy of threatening 100% tariffs on Canadian goods while simultaneously pressuring

Via MarketMinute · January 30, 2026

As of January 2026, the artificial intelligence landscape has transitioned from a period of desperate hardware scarcity to an era of fierce architectural competition. While NVIDIA Corporation (NASDAQ: NVDA) maintained a near-monopoly on high-end AI training for years, the narrative has shifted in the enterprise data center. The arrival of the Advanced Micro Devices, Inc. [...]

Via TokenRing AI · January 30, 2026

In a move that solidifies its lead in the high-stakes artificial intelligence memory race, SK Hynix (KRX: 000660) has officially announced a massive $13 billion (19 trillion won) investment to construct "P&T7," slated to be the world's largest dedicated High Bandwidth Memory (HBM) packaging and testing facility. Located in the Cheongju Technopolis Industrial Complex in [...]

Via TokenRing AI · January 30, 2026

In a financial performance that has stunned even the most bullish Wall Street analysts, NVIDIA (NASDAQ: NVDA) has reported a staggering $57 billion in revenue for the third quarter of its fiscal year 2026. This milestone, primarily driven by a 66% year-over-year surge in its Data Center division, underscores an insatiable global appetite for artificial [...]

Via TokenRing AI · January 30, 2026

The company recently announced it would be laying off 10% of the staff from its Reality Labs division.

Via The Motley Fool · January 30, 2026

As of late January 2026, the artificial intelligence revolution has transitioned from a speculative sprint into a permanent industrial fixture, and at the center of this new world order stands Nvidia (NASDAQ: NVDA). Despite the rising tide of competition and intensifying regulatory scrutiny, the Santa Clara-based titan continues to exert

Via MarketMinute · January 30, 2026

MENLO PARK, CA — Meta Platforms (NASDAQ: META) shares skyrocketed nearly 10% in a historic trading session on January 29, 2026, following a fourth-quarter earnings report that fundamentally shifted the narrative around Big Tech’s massive artificial intelligence investments. The surge added approximately $170 billion to the company’s market capitalization,

Via MarketMinute · January 30, 2026

As of January 30, 2026, the way we consume news on X (formerly Twitter) has undergone a fundamental shift. No longer just a scroll of opinions and viral clips, the platform has transformed into what analysts are calling an "Information Finance" (InfoFi) engine. The cornerstone of this transformation is the seamless integration of live prediction [...]

Via PredictStreet · January 30, 2026

In a historic display of market resilience and technological optimism, the S&P 500 index officially crossed the 7,000-point threshold on January 28, 2026. This monumental achievement marks a new era for Wall Street, coming just fourteen months after the index first touched 6,000 in late 2024. The

Via MarketMinute · January 30, 2026

As of January 30, 2026, the global financial landscape is witnessing the official dawn of "InfoFi"—Information Finance. Prediction markets, once relegated to the fringes of the internet and academic white papers, have shattered the glass ceiling of mainstream adoption. This shift is being driven by a historic pivot from Silicon Valley’s titans, most notably Alphabet [...]

Via PredictStreet · January 30, 2026

SANTA CLARA, CA — The stratospheric rise of the artificial intelligence sector faced a grueling reality check this week as shares of Advanced Micro Devices (NASDAQ:AMD) plummeted 11%, wiping out billions in market capitalization. The sell-off, which began following a series of conservative forecasts from industry peers and persistent rumors

Via MarketMinute · January 30, 2026

As January 2026 draws to a close, the global financial markets are standing at the precipice of what many economists are calling the "AI Earnings Supercycle." After three years of intensive capital expenditure and experimental pilots, the narrative of artificial intelligence has shifted from speculative hype to a rigorous, margin-focused

Via MarketMinute · January 30, 2026