Microsoft (MSFT)

430.29

-3.21 (-0.74%)

NASDAQ · Last Trade: Jan 31st, 3:49 AM EST

Detailed Quote

| Previous Close | 433.50 |

|---|---|

| Open | 439.17 |

| Bid | 428.78 |

| Ask | 428.87 |

| Day's Range | 426.45 - 439.60 |

| 52 Week Range | 344.79 - 555.45 |

| Volume | 58,573,149 |

| Market Cap | 3.25T |

| PE Ratio (TTM) | - |

| EPS (TTM) | - |

| Dividend & Yield | 3.640 (0.85%) |

| 1 Month Average Volume | 33,134,307 |

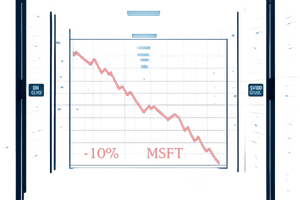

Chart

About Microsoft (MSFT)

Microsoft is a leading global technology company known for its software products, services, and hardware devices. The company is best recognized for its Windows operating systems and the Microsoft Office suite, which facilitates productivity and collaboration for users worldwide. In addition to software, Microsoft also offers cloud computing services through its Azure platform, enabling businesses to leverage scalable and flexible computing resources. The company is actively involved in various sectors, including gaming with its Xbox platform, artificial intelligence, and cybersecurity, continually innovating and expanding its product offerings to meet the diverse needs of consumers and enterprises. Read More

News & Press Releases

The Vanguard Information Technology ETF is missing some key long-term pieces.

Via The Motley Fool · January 31, 2026

SaaS stocks have plunged on AI fears.

Via The Motley Fool · January 31, 2026

Software was eating the world in the early 2010s. Is AI eating software today?

Via The Motley Fool · January 30, 2026

After a volatile start to 2026, these three dividend stocks combine strong early momentum, analyst support, and income potential for the year ahead.

Via Barchart.com · January 30, 2026

Apple’s earnings confirmed resilient demand and record-breaking iPhone sales, while investor attention quickly shifts to supply constraints and the company’s evolving AI strategy.

Via The Motley Fool · January 30, 2026

Gold’s record plunge as precious metals and growth stocks pull back today, Jan. 30, 2026.

Via The Motley Fool · January 30, 2026

In a jarring disconnect between fiscal performance and market sentiment, ServiceNow (NYSE: NOW) saw its shares crater by nearly 10% on January 29, 2026, despite delivering a Fourth Quarter 2025 report that exceeded analyst expectations on every major metric. The enterprise software giant, long considered a bellwether for the digital

Via MarketMinute · January 30, 2026

AUSTIN, TX - January 30, 2026 - Enterprise ERP consultancies managing SAP, Oracle, NetSuite, and Microsoft Dynamics implementations face a growing knowledge crisis: millions of dollars in training videos that cannot be searched, referenced, or reused across client engagements.

Via AB Newswire · January 30, 2026

International Business Machines (NYSE: IBM) has stunned Wall Street with a powerhouse fourth-quarter earnings report that sent its stock price soaring by more than 10% in the days following the release. As of January 30, 2026, the tech giant’s shares have reached multi-year highs, trading near the $315 mark—

Via MarketMinute · January 30, 2026

Reports surfaced this week that Amazon.com, Inc. (NASDAQ:AMZN) is in advanced negotiations to invest a staggering $50 billion into OpenAI, the world’s leading artificial intelligence laboratory. This potential deal, first reported by major financial outlets on January 29, 2026, marks a seismic shift in the "AI Arms

Via MarketMinute · January 30, 2026

In a jarring reminder that even the world’s most valuable companies are not immune to the gravity of market expectations, Microsoft Corp. (NASDAQ:MSFT) saw its shares plunge nearly 10% following its Q2 FY2026 earnings report on January 28, 2026. Despite beating top and bottom-line estimates with total revenue

Via MarketMinute · January 30, 2026

MENLO PARK, CA — In a resounding validation of its aggressive pivot toward artificial intelligence, Meta Platforms (NASDAQ:META) saw its stock price skyrocket by 9% in late January 2026. The surge followed a blowout fourth-quarter earnings report that silenced critics of the company’s massive capital expenditure and established the

Via MarketMinute · January 30, 2026

Apple Inc. (NASDAQ: AAPL) delivered a commanding performance in its fiscal first-quarter earnings report on January 29, 2026, shattering revenue and profit records on the back of explosive demand for the iPhone 17. Despite exceeding analyst expectations across nearly every major metric, the tech giant saw its stock price decline

Via MarketMinute · January 30, 2026

Calgary, AB - January 30, 2026 - Project Coordinator David Torske is calling for greater awareness and effort around jobsite communication, urging construction teams to take small but consistent steps to improve how they share information, manage schedules, and solve problems together.

Via Get News · January 30, 2026

In a move that sent immediate shockwaves through global financial markets, President Donald Trump officially nominated former Federal Reserve Governor Kevin Warsh to succeed Jerome Powell as the Chair of the Federal Reserve. The announcement, made on the morning of January 30, 2026, represents a fundamental shift in the leadership

Via MarketMinute · January 30, 2026

The dip in MSFT stock appears to be overdone. This is why value investors can look into various strategy plays.

Via Talk Markets · January 30, 2026

Stock Yards Bancorp delivers commercial banking and wealth management services across key Midwest metropolitan markets.

Via The Motley Fool · January 30, 2026

President Trump nominates Kevin Warsh as next Chair of Federal Reserve, signaling a less aggressive policy and reversing market trends.

Via Benzinga · January 30, 2026

As investors have shifted away from software providers and toward hardware and specialized AI winners, software stocks have taken a hit. Here's what's going on in this sector right now.

Via Barchart.com · January 30, 2026

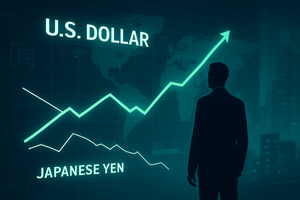

WASHINGTON D.C. — The global currency markets have been sent into a whirlwind this week as the U.S. Dollar staged a powerful recovery against the Japanese Yen. The surge followed definitive comments from U.S. Treasury Secretary Scott Bessent, who effectively shut the door on rumors of a coordinated

Via MarketMinute · January 30, 2026

The final week of January 2026 has been defined by a return to "tariff diplomacy" and a surreal geopolitical standoff over the world’s largest island, sending ripples of volatility through the S&P 500. President Trump’s dual-track strategy of threatening 100% tariffs on Canadian goods while simultaneously pressuring

Via MarketMinute · January 30, 2026

The United States labor market once again demonstrated its remarkable durability as initial jobless claims for the week ending January 24, 2026, fell to a seasonally adjusted 200,000. This figure arrived significantly lower than the consensus forecast of 206,000, signaling that despite high interest rates and a cooling

Via MarketMinute · January 30, 2026

SEATTLE — In a move that has sent tremors through Silicon Valley and Wall Street, reports surfaced today, January 30, 2026, that Amazon.com Inc. (NASDAQ:AMZN) is in advanced negotiations to invest a staggering $50 billion into OpenAI. This unprecedented capital injection, if finalized, would mark the largest single investment

Via MarketMinute · January 30, 2026

In a high-stakes moment for the technology sector, Apple (NASDAQ: AAPL) delivered a resounding rebuke to skeptics on January 29, 2026, reporting record-breaking results for its holiday quarter. While the company’s stock has spent much of the past year acting as a significant weight on the S&P 500

Via MarketMinute · January 30, 2026

Wall Street etched a new chapter in financial history this week as the S&P 500 index briefly surged past the 7,000-point threshold for the first time, marking a breathtaking ascent that has redefined investor expectations for the decade. On January 28, 2026, the benchmark index touched an intraday

Via MarketMinute · January 30, 2026