MP Materials Corp. Common Stock (MP)

57.30

+0.00 (0.00%)

NYSE · Last Trade: Feb 13th, 5:49 AM EST

Detailed Quote

| Previous Close | 57.30 |

|---|---|

| Open | - |

| Bid | 57.00 |

| Ask | 57.28 |

| Day's Range | N/A - N/A |

| 52 Week Range | 18.64 - 100.25 |

| Volume | 1,991 |

| Market Cap | 10.18B |

| PE Ratio (TTM) | -81.86 |

| EPS (TTM) | -0.7 |

| Dividend & Yield | N/A (N/A) |

| 1 Month Average Volume | 9,745,484 |

Chart

About MP Materials Corp. Common Stock (MP)

MP Materials Corp is a leading firm in the rare earth materials industry, primarily focused on the production and processing of rare earth elements essential for various advanced technologies. The company operates a significant mining and manufacturing complex, where it extracts and refines these critical materials, which are vital for applications in electric vehicles, renewable energy systems, defense technologies, and many electronics. By harnessing these resources domestically, MP Materials aims to support the growing demand for rare earths while promoting a more sustainable supply chain in the United States. Read More

News & Press Releases

NATO's action across the pond has investors uneasy about this rare earth stock today.

Via The Motley Fool · February 12, 2026

Securing a domestic supply of critical rare-earth materials and magnets is a priority for the current administration, which means USA Rare Earth is in favor.

Via The Motley Fool · February 12, 2026

As of February 11, 2026, the global economy is navigating the aftershocks of a geopolitical standoff that nearly dismantled the post-war trade order. The "Greenland Tariff Escalation," a high-stakes diplomatic confrontation sparked by the United States’ aggressive pursuit of the world’s largest island, has shifted from an imminent trade

Via MarketMinute · February 11, 2026

MP Materials surged 224% in 2025. Can the rare-earth miner beat the market in 2026?

Via The Motley Fool · February 11, 2026

Is this deal as good as it seems for USA Rare Earth?

Via The Motley Fool · February 10, 2026

Via MarketBeat · February 9, 2026

These mining stocks could help you hit pay dirt.

Via The Motley Fool · February 9, 2026

The periodic table never looked so lucrative. These three mining stocks want to capture the upside.

Via The Motley Fool · February 7, 2026

The geopolitical landscape was rocked in early 2026 by the so-called "Greenland Episode," a diplomatic and economic confrontation that has pushed the relationship between the United States and the European Union to its lowest point in decades. What began as a renewed U.S. strategic interest in the Arctic territory

Via MarketMinute · February 6, 2026

The rare earth stock could vault higher in 2026 if it meets this crucial target.

Via The Motley Fool · February 6, 2026

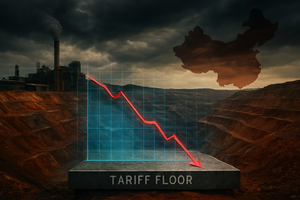

In a move that has sent shockwaves through global commodities markets, rare earth and critical materials stocks suffered a sharp sell-off this week following the U.S. administration's announcement of a "tariff floor" policy. The new regulatory framework, unveiled by Vice President J.D. Vance during a Critical Minerals Ministerial

Via MarketMinute · February 5, 2026

Critical Minerals: The Backbone of the Energy Transition and a Growing Global Market

By MarketNewsUpdates.com · Via GlobeNewswire · February 5, 2026

EQNX::TICKER_START (OTCQB:NIOMF),(CSE:NIOB),(NASDAQ:NB),(NYSE:MP),(OTCQX:APXCF),(OTCQB:TUNGF) EQNX::TICKER_END

Via FinancialNewsMedia · February 5, 2026

According to a Financial Times report, the proposal aims to secure the institution’s financing authority for another decade while boosting its capacity to back strategic industries.

Via Stocktwits · February 4, 2026

Manufacturing Wakes Up, Stocks Party Onchartmill.com

Via Chartmill · February 3, 2026

The announcement, delivered from the East Room alongside the CEOs of the nation's largest industrial titans, marks a fundamental shift in U.S. economic policy. By treating critical minerals with the same strategic gravity as crude oil, the administration intends to provide a "sovereign shock absorber" for domestic manufacturers. For

Via MarketMinute · February 2, 2026

In a move set to redefine the physical limits of artificial intelligence hardware, the United States and Japan have formalized a series of landmark agreements aimed at fortifying the semiconductor supply chain. At the heart of this alliance is a proposed $500 million synthetic diamond production facility in the U.S. and a comprehensive rare earth [...]

Via TokenRing AI · February 2, 2026

MP Materials Corp (NYSE:MP) shares are moving higher on Monday after reports that President Donald Trump aims to reduce China's dominance in rare earth materials through a $12 billion strategic stockpile of critical minerals.

Via Benzinga · February 2, 2026

Via MarketBeat · February 2, 2026

The global financial markets are still reeling after a tumultuous January that saw the return of "Twitter-diplomacy" and high-stakes protectionism. Following President Donald Trump’s aggressive mid-month demand for the United States to purchase Greenland, a move punctuated by threats of sweeping tariffs against European allies, the Dow Jones Industrial

Via MarketMinute · February 2, 2026

MP Materials has surged almost 200% since last year. Can it beat the market in 2026?

Via The Motley Fool · January 31, 2026

The final week of January 2026 has been defined by a return to "tariff diplomacy" and a surreal geopolitical standoff over the world’s largest island, sending ripples of volatility through the S&P 500. President Trump’s dual-track strategy of threatening 100% tariffs on Canadian goods while simultaneously pressuring

Via MarketMinute · January 30, 2026

The global financial landscape has been jolted by a profound "Greenland rift" as the United States aggressively asserts its territorial ambitions over the autonomous Danish territory. This geopolitical friction, which reached a fever pitch in January 2026, has pitted Washington against Copenhagen and Brussels, triggering an unprecedented deployment of European

Via MarketMinute · January 30, 2026

Investor sentiment whiplashed over rare-earth stocks this week.

Via The Motley Fool · January 30, 2026

Investor sentiment shifted sharply over the course of a week after the company announced a transformative agreement with the U.S. Government.

Via The Motley Fool · January 30, 2026