Let’s dig into the relative performance of YETI (NYSE:YETI) and its peers as we unravel the now-completed Q2 leisure products earnings season.

Leisure products cover a wide range of goods in the consumer discretionary sector. Maintaining a strong brand is key to success, and those who differentiate themselves will enjoy customer loyalty and pricing power while those who don’t may find themselves in precarious positions due to the non-essential nature of their offerings.

The 12 leisure products stocks we track reported a mixed Q2. As a group, revenues beat analysts’ consensus estimates by 3.5% while next quarter’s revenue guidance was 0.7% below.

In light of this news, share prices of the companies have held steady as they are up 4.7% on average since the latest earnings results.

YETI (NYSE:YETI)

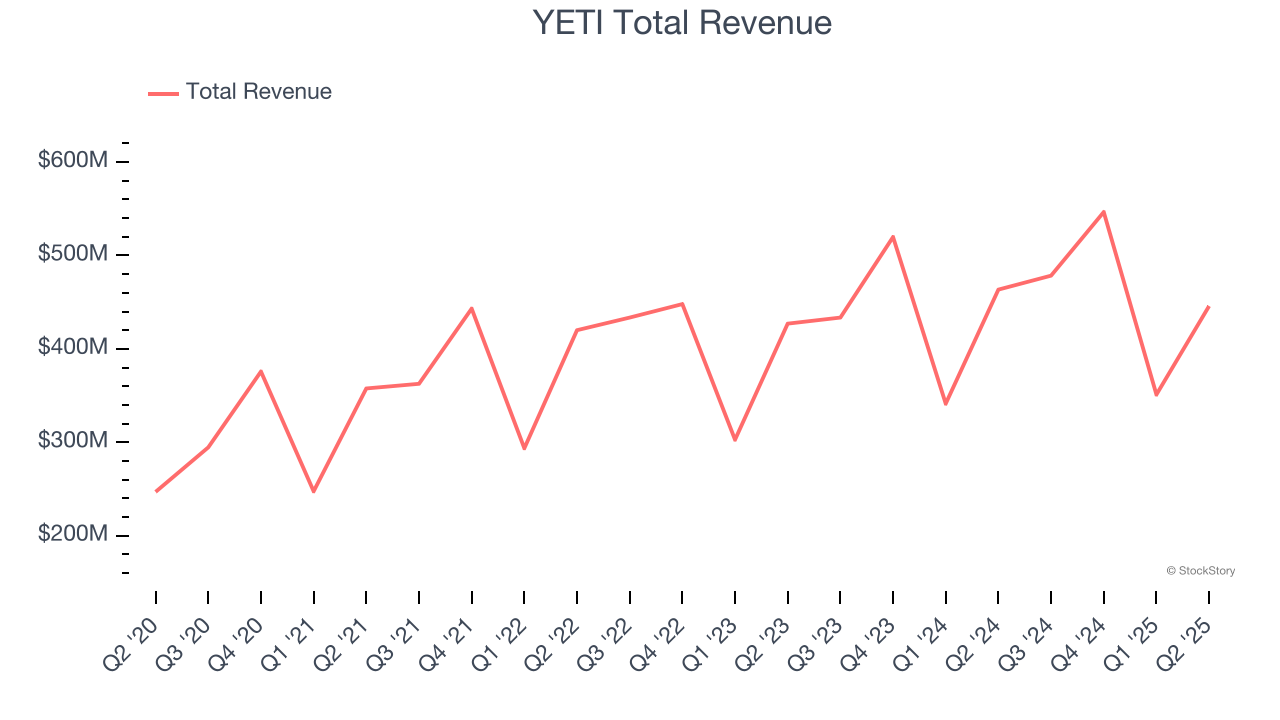

Founded by two brothers from Texas, YETI (NYSE:YETI) specializes in durable outdoor goods including coolers, drinkware, and other gear tailored to adventure enthusiasts.

YETI reported revenues of $445.9 million, down 3.8% year on year. This print fell short of analysts’ expectations by 3.7%, but it was still a very strong quarter for the company with full-year EPS guidance exceeding analysts’ expectations and a solid beat of analysts’ adjusted operating income estimates.

Matt Reintjes, President and Chief Executive Officer, commented, “We are making excellent progress on our long-term strategic priorities—accelerating innovation, expanding our global brand, and diversifying our supply chain. We are seeing these strategies play out in the market with momentum in product innovation and diversification across our portfolio with notable strength in bags, our global expansion with exceptional performance in the UK and Europe and strong end user demand in Canada and Australia, and the transformational shift in our supply chain. Our brand continues to expand, connecting both domestically and, importantly, globally. Amidst a disruptive macroeconomic environment, we are positioning YETI to deliver long-term, sustainable top and bottom-line growth supported by a strong financial foundation. Our strong balance sheet and robust free cash flow generation are enabling investment in growth initiatives while also advancing our capital allocation priorities, including share repurchases. We exited the second quarter with encouraging momentum across our key growth drivers, and we are seeing signs of continued improvement in the third quarter, reinforcing our confidence in the trajectory ahead.”

The market was likely pricing in the results, and the stock is flat since reporting. It currently trades at $36.10.

Is now the time to buy YETI? Access our full analysis of the earnings results here, it’s free.

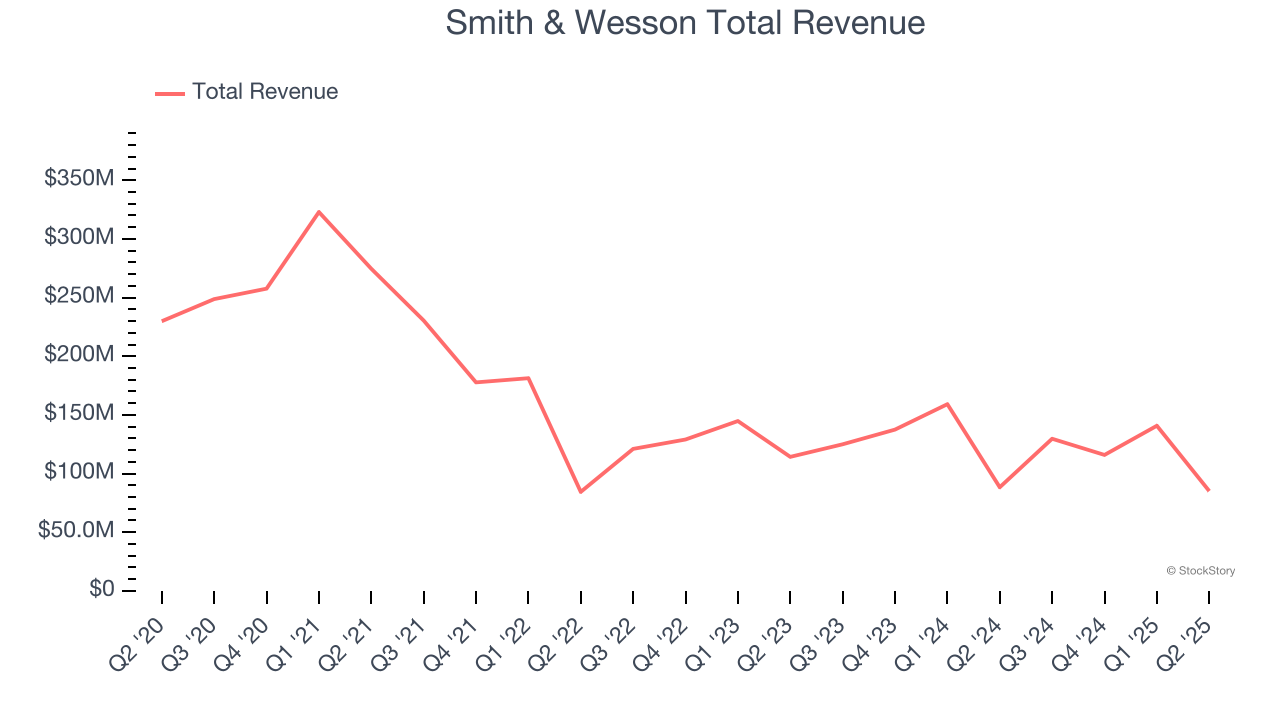

Best Q2: Smith & Wesson (NASDAQ:SWBI)

With a history dating back to 1852, Smith & Wesson (NASDAQ:SWBI) is a firearms manufacturer known for its handguns and rifles.

Smith & Wesson reported revenues of $85.08 million, down 3.7% year on year, outperforming analysts’ expectations by 7.4%. The business had an incredible quarter with a beat of analysts’ EPS estimates and an impressive beat of analysts’ EBITDA estimates.

The market seems happy with the results as the stock is up 5.9% since reporting. It currently trades at $8.70.

Is now the time to buy Smith & Wesson? Access our full analysis of the earnings results here, it’s free.

Weakest Q2: American Outdoor Brands (NASDAQ:AOUT)

Spun off from Smith and Wesson in 2020, American Outdoor Brands (NASDAQ:AOUT) is an outdoor and recreational products company that offers outdoor and shooting sports products but does not sell firearms themselves.

American Outdoor Brands reported revenues of $29.7 million, down 28.7% year on year, falling short of analysts’ expectations by 17%. It was a disappointing quarter as it posted a significant miss of analysts’ EBITDA estimates and a significant miss of analysts’ EPS estimates.

American Outdoor Brands delivered the weakest performance against analyst estimates and slowest revenue growth in the group. As expected, the stock is down 16.4% since the results and currently trades at $8.69.

Read our full analysis of American Outdoor Brands’s results here.

Malibu Boats (NASDAQ:MBUU)

Founded in California in 1982, Malibu Boats (NASDAQ:MBUU) is a manufacturer of high-performance sports boats and luxury watercrafts.

Malibu Boats reported revenues of $207 million, up 30.4% year on year. This print beat analysts’ expectations by 5.4%. More broadly, it was a slower quarter as it logged a significant miss of analysts’ EPS estimates and a miss of analysts’ adjusted operating income estimates.

The stock is down 16% since reporting and currently trades at $33.23.

Read our full, actionable report on Malibu Boats here, it’s free.

Latham (NASDAQ:SWIM)

Started as a family business, Latham (NASDAQ:SWIM) is a global designer and manufacturer of in-ground residential swimming pools and related products.

Latham reported revenues of $172.6 million, up 7.8% year on year. This result came in 1.4% below analysts' expectations. Aside from that, it was a mixed quarter as it also recorded a solid beat of analysts’ adjusted operating income estimates but EPS in line with analysts’ estimates.

The stock is up 20.5% since reporting and currently trades at $8.24.

Read our full, actionable report on Latham here, it’s free.

Market Update

As a result of the Fed’s rate hikes in 2022 and 2023, inflation has come down from frothy levels post-pandemic. The general rise in the price of goods and services is trending towards the Fed’s 2% goal as of late, which is good news. The higher rates that fought inflation also didn't slow economic activity enough to catalyze a recession. So far, soft landing. This, combined with recent rate cuts (half a percent in September 2024 and a quarter percent in November 2024) have led to strong stock market performance in 2024. The icing on the cake for 2024 returns was Donald Trump’s victory in the U.S. Presidential Election in early November, sending major indices to all-time highs in the week following the election. Still, debates around the health of the economy and the impact of potential tariffs and corporate tax cuts remain, leaving much uncertainty around 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Top 6 Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.