The end of an earnings season can be a great time to discover new stocks and assess how companies are handling the current business environment. Let’s take a look at how McCormick (NYSE:MKC) and the rest of the shelf-stable food stocks fared in Q4.

As America industrialized and moved away from an agricultural economy, people faced more demands on their time. Packaged foods emerged as a solution offering convenience to the evolving American family, whether it be canned goods or snacks. Today, Americans seek brands that are high in quality, reliable, and reasonably priced. Furthermore, there's a growing emphasis on health-conscious and sustainable food options. Packaged food stocks are considered resilient investments. People always need to eat, so these companies can enjoy consistent demand as long as they stay on top of changing consumer preferences. The industry spans from multinational corporations to smaller specialized firms and is subject to food safety and labeling regulations.

The 21 shelf-stable food stocks we track reported a mixed Q4. As a group, revenues were in line with analysts’ consensus estimates while next quarter’s revenue guidance was 0.5% above.

While some shelf-stable food stocks have fared somewhat better than others, they have collectively declined. On average, share prices are down 2.9% since the latest earnings results.

McCormick (NYSE:MKC)

The classic red Heinz ketchup bottle’s competitor, McCormick (NYSE:MKC) sells food-flavoring products like condiments, spices, and seasoning mixes.

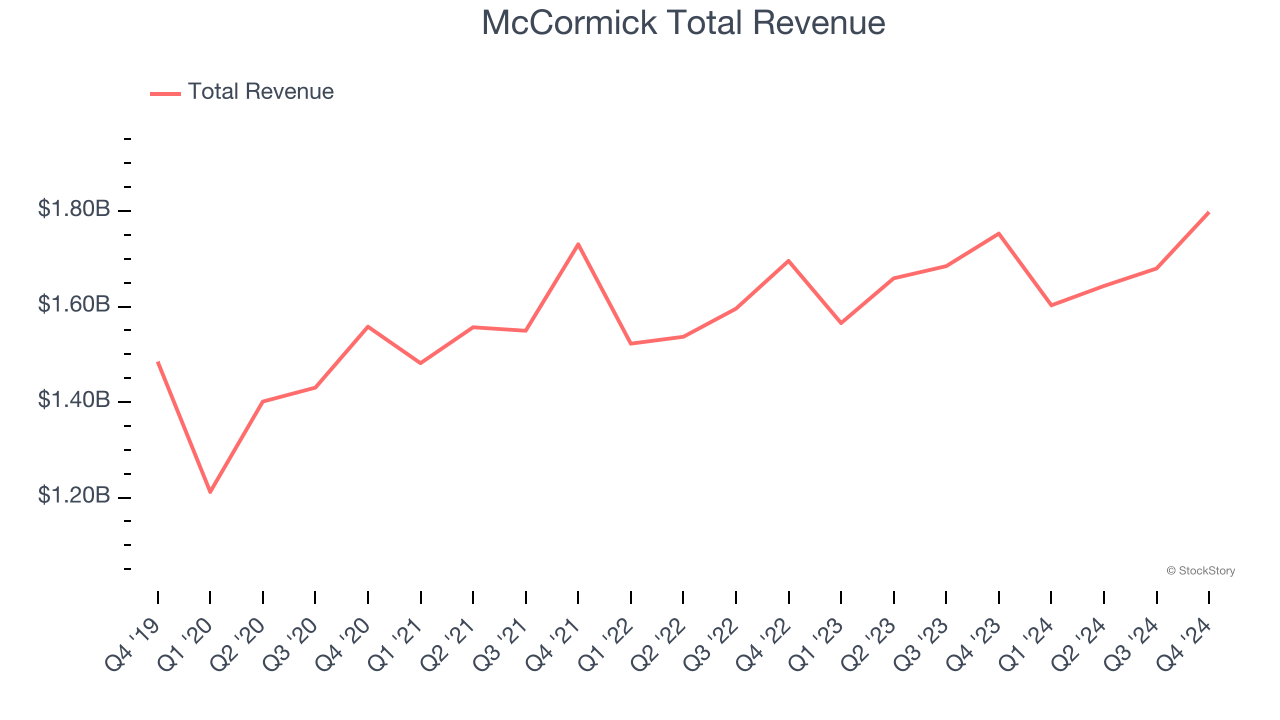

McCormick reported revenues of $1.80 billion, up 2.6% year on year. This print exceeded analysts’ expectations by 1.2%. Despite the top-line beat, it was still a mixed quarter for the company with a decent beat of analysts’ EPS estimates but a slight miss of analysts’ EBITDA estimates.

Brendan M. Foley, Chairman, President, and CEO, stated, "We are pleased to report strong performance for both fourth quarter and fiscal year 2024, an important year for McCormick, in which we built momentum and strengthened our leadership, returning to differentiated and sustainable volume-led growth. We successfully delivered on our objectives for the year. Our strategic investments in core categories enabled us to drive positive volume growth, expand our margins, and deliver robust earnings growth. Additionally, we achieved another year of strong cash flow, paid down debt, and reduced our leverage ratio, further strengthening our balance sheet."

The stock is up 10.1% since reporting and currently trades at $80.63.

Read our full report on McCormick here, it’s free.

Best Q4: Lancaster Colony (NASDAQ:LANC)

Known for its frozen garlic bread and Parkerhouse rolls, Lancaster Colony (NASDAQ:LANC) sells bread, dressing, and dips to the retail and food service channels.

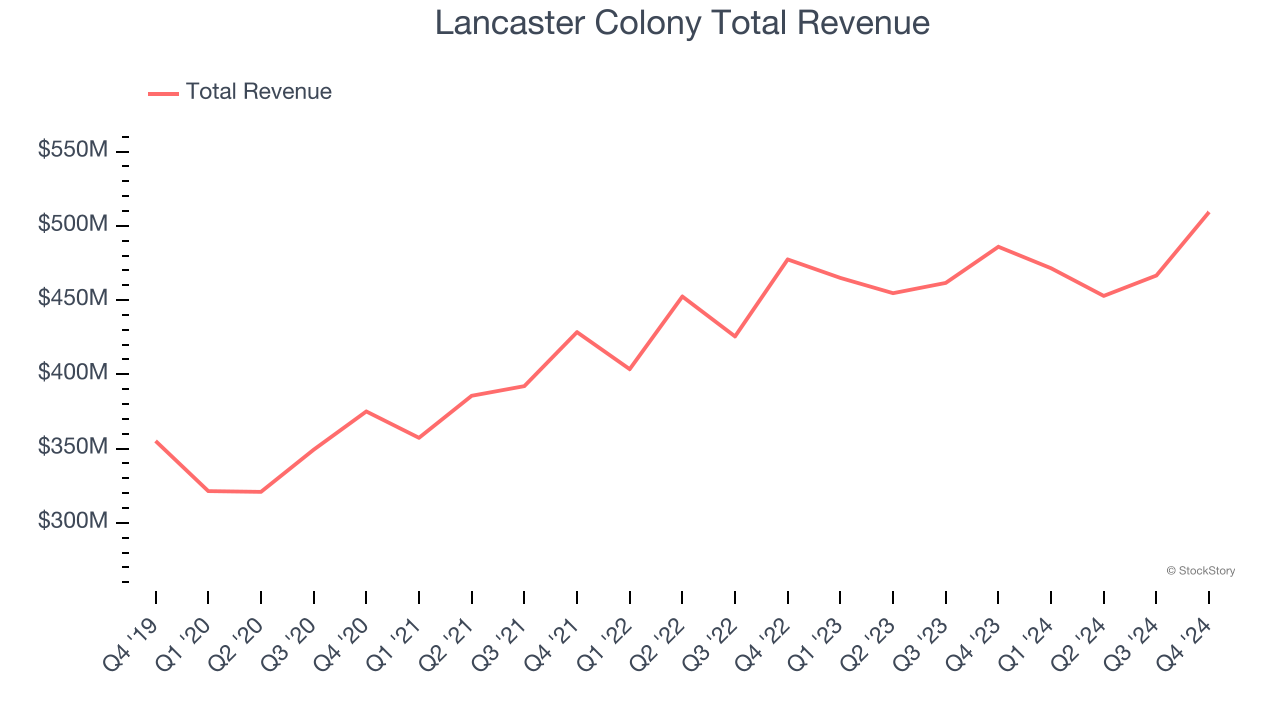

Lancaster Colony reported revenues of $509.3 million, up 4.8% year on year, outperforming analysts’ expectations by 2.8%. The business had a very strong quarter with an impressive beat of analysts’ EBITDA estimates and a solid beat of analysts’ adjusted operating income estimates.

Lancaster Colony scored the biggest analyst estimates beat among its peers. The market seems happy with the results as the stock is up 7.1% since reporting. It currently trades at $178.27.

Is now the time to buy Lancaster Colony? Access our full analysis of the earnings results here, it’s free.

Weakest Q4: Lamb Weston (NYSE:LW)

Best known for its Grown in Idaho brand, Lamb Weston (NYSE:LW) produces and distributes potato products such as frozen french fries and mashed potatoes.

Lamb Weston reported revenues of $1.60 billion, down 7.6% year on year, falling short of analysts’ expectations by 4.3%. It was a disappointing quarter as it posted full-year revenue guidance missing analysts’ expectations.

Lamb Weston delivered the weakest full-year guidance update in the group. As expected, the stock is down 38.2% since the results and currently trades at $48.27.

Read our full analysis of Lamb Weston’s results here.

BellRing Brands (NYSE:BRBR)

Spun out of Post Holdings in 2019, Bellring Brands (NYSE:BRBR) offers protein shakes, nutrition bars, and other products under the PowerBar, Premier Protein, and Dymatize brands.

BellRing Brands reported revenues of $532.9 million, up 23.8% year on year. This result topped analysts’ expectations by 1.2%. It was a strong quarter as it also logged an impressive beat of analysts’ EBITDA estimates and a solid beat of analysts’ gross margin estimates.

BellRing Brands delivered the fastest revenue growth and highest full-year guidance raise among its peers. The stock is down 16.2% since reporting and currently trades at $65.50.

Read our full, actionable report on BellRing Brands here, it’s free.

Kraft Heinz (NASDAQ:KHC)

The result of a 2015 mega-merger between Kraft and Heinz, Kraft Heinz (NASDAQ:KHC) is a packaged foods giant whose products span coffee to cheese to packaged meat.

Kraft Heinz reported revenues of $6.58 billion, down 4.1% year on year. This number came in 1.3% below analysts' expectations. It was a slower quarter as it also recorded full-year EPS guidance missing analysts’ expectations significantly and a miss of analysts’ organic revenue estimates.

The stock is up 1.9% since reporting and currently trades at $30.17.

Read our full, actionable report on Kraft Heinz here, it’s free.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Growth Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.