As the craze of earnings season draws to a close, here’s a look back at some of the most exciting (and some less so) results from Q3. Today, we are looking at consumer staples stocks, starting with Cal-Maine (NASDAQ:CALM).

The consumer staples industry comprises companies engaged in the manufacturing, distribution, and sale of essential, everyday products. These products, also known as "staples," are fundamental to daily living and include packaged food, beverages and alcohol, personal care, and household products. Consumer staples stocks are considered defensive investments because consumers often purchase them regardless of economic conditions. To stand out, companies must have some combination of brand recognition, product quality, and price competitiveness.

The 14 consumer staples stocks we track reported a mixed Q3. As a group, revenues beat analysts’ consensus estimates by 1%.

In light of this news, share prices of the companies have held steady. On average, they are relatively unchanged since the latest earnings results.

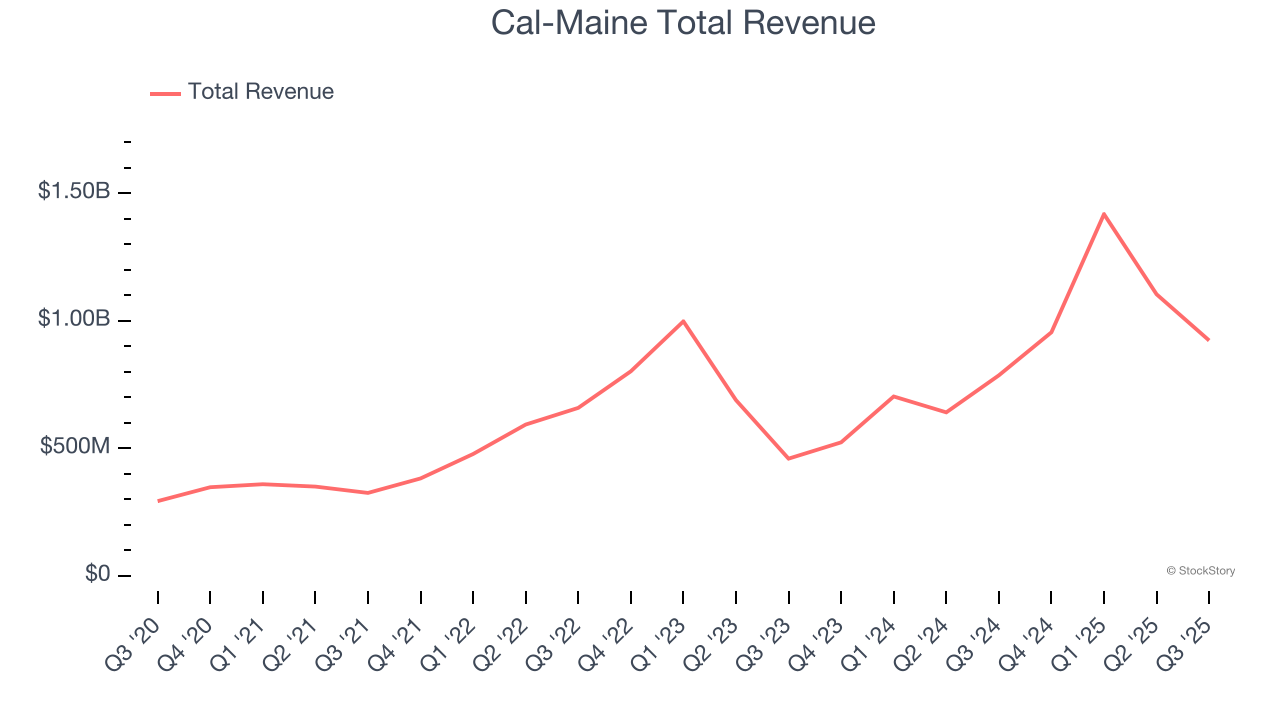

Weakest Q3: Cal-Maine (NASDAQ:CALM)

Known for brands such as Egg-Land’s Best and Land O’ Lakes, Cal-Maine (NASDAQ:CALM) produces, packages, and distributes eggs.

Cal-Maine reported revenues of $922.6 million, up 17.4% year on year. This print fell short of analysts’ expectations by 3.9%. Overall, it was a disappointing quarter for the company with a significant miss of analysts’ adjusted operating income estimates.

“We delivered our strongest first quarter in company history, aided by higher specialty egg sales, the expansion of our prepared foods platform, and supported by solid performance in conventional eggs. Cal-Maine Foods enters fiscal 2026 from a position of strength and is a uniquely attractive combination of both value and growth in today’s food sector,” said Sherman Miller, president and chief executive officer of Cal-Maine Foods.

Cal-Maine achieved the fastest revenue growth but had the weakest performance against analyst estimates of the whole group. Still, the market seems discontent with the results. The stock is down 19.7% since reporting and currently trades at $90.49.

Is now the time to buy Cal-Maine? Access our full analysis of the earnings results here, it’s free for active Edge members.

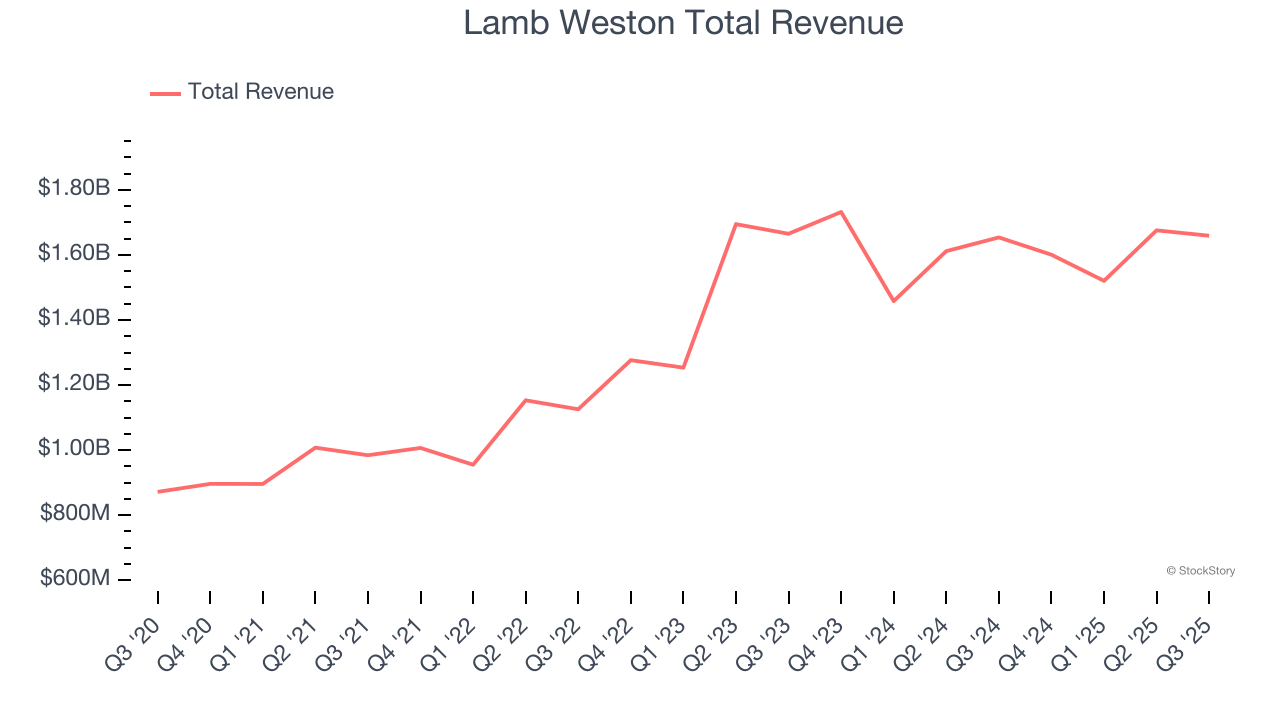

Best Q3: Lamb Weston (NYSE:LW)

Best known for its Grown in Idaho brand, Lamb Weston (NYSE:LW) produces and distributes potato products such as frozen french fries and mashed potatoes.

Lamb Weston reported revenues of $1.66 billion, flat year on year, outperforming analysts’ expectations by 2.6%. The business had a very strong quarter with an impressive beat of analysts’ EBITDA estimates.

The market seems happy with the results as the stock is up 19.7% since reporting. It currently trades at $66.66.

Is now the time to buy Lamb Weston? Access our full analysis of the earnings results here, it’s free for active Edge members.

PepsiCo (NASDAQ:PEP)

With a history that goes back more than a century, PepsiCo (NASDAQ:PEP) is a household name in food and beverages today and best known for its flagship soda.

PepsiCo reported revenues of $23.94 billion, up 2.7% year on year, in line with analysts’ expectations. It was a mixed quarter as it posted revenue in line with analysts’ estimates but a slight miss of analysts’ organic revenue estimates.

Interestingly, the stock is up 9.6% since the results and currently trades at $152.

Read our full analysis of PepsiCo’s results here.

Conagra (NYSE:CAG)

Founded in 1919 as Nebraska Consolidated Mills in Omaha, Nebraska, Conagra Brands today (NYSE:CAG) boasts a diverse portfolio of packaged foods brands that includes everything from whipped cream to jarred pickles to frozen meals.

Conagra reported revenues of $2.63 billion, down 5.8% year on year. This result beat analysts’ expectations by 0.7%. Overall, it was a very strong quarter as it also produced a solid beat of analysts’ EBITDA estimates and an impressive beat of analysts’ gross margin estimates.

The stock is flat since reporting and currently trades at $18.30.

Read our full, actionable report on Conagra here, it’s free for active Edge members.

USANA (NYSE:USNA)

Going to market with a direct selling model rather than through traditional retailers, USANA Health Sciences (NYSE:USNA) manufactures and sells nutritional, personal care, and skincare products.

USANA reported revenues of $213.7 million, up 6.7% year on year. This number was in line with analysts’ expectations. Zooming out, it was a satisfactory quarter as it also recorded a solid beat of analysts’ EBITDA estimates but a miss of analysts’ gross margin estimates.

USANA achieved the highest full-year guidance raise among its peers. The stock is flat since reporting and currently trades at $20.80.

Read our full, actionable report on USANA here, it’s free for active Edge members.

Market Update

In response to the Fed’s rate hikes in 2022 and 2023, inflation has been gradually trending down from its post-pandemic peak, trending closer to the Fed’s 2% target. Despite higher borrowing costs, the economy has avoided flashing recessionary signals. This is the much-desired soft landing that many investors hoped for. The recent rate cuts (0.5% in September and 0.25% in November 2024) have bolstered the stock market, making 2024 a strong year for equities. Donald Trump’s presidential win in November sparked additional market gains, sending indices to record highs in the days following his victory. However, debates continue over possible tariffs and corporate tax adjustments, raising questions about economic stability in 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Hidden Gem Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.