GameStop currently trades at $32.17 and has been a dream stock for shareholders. It’s returned 2,081% since December 2019, blowing past the S&P 500’s 85.7% gain. The company has also beaten the index over the past six months as its stock price is up 28.2% thanks to its solid quarterly results.

Is there a buying opportunity in GameStop, or does it present a risk to your portfolio? Get the full breakdown from our expert analysts, it’s free.We’re happy investors have made money, but we're sitting this one out for now. Here are three reasons why GME doesn't excite us and a stock we'd rather own.

Why Do We Think GameStop Will Underperform?

Drawing gaming fans with demo units set up with the latest releases, GameStop (NYSE:GME) sells new and used video games, consoles, and accessories, as well as pop culture merchandise.

1. Shrinking Same-Store Sales Indicate Waning Demand

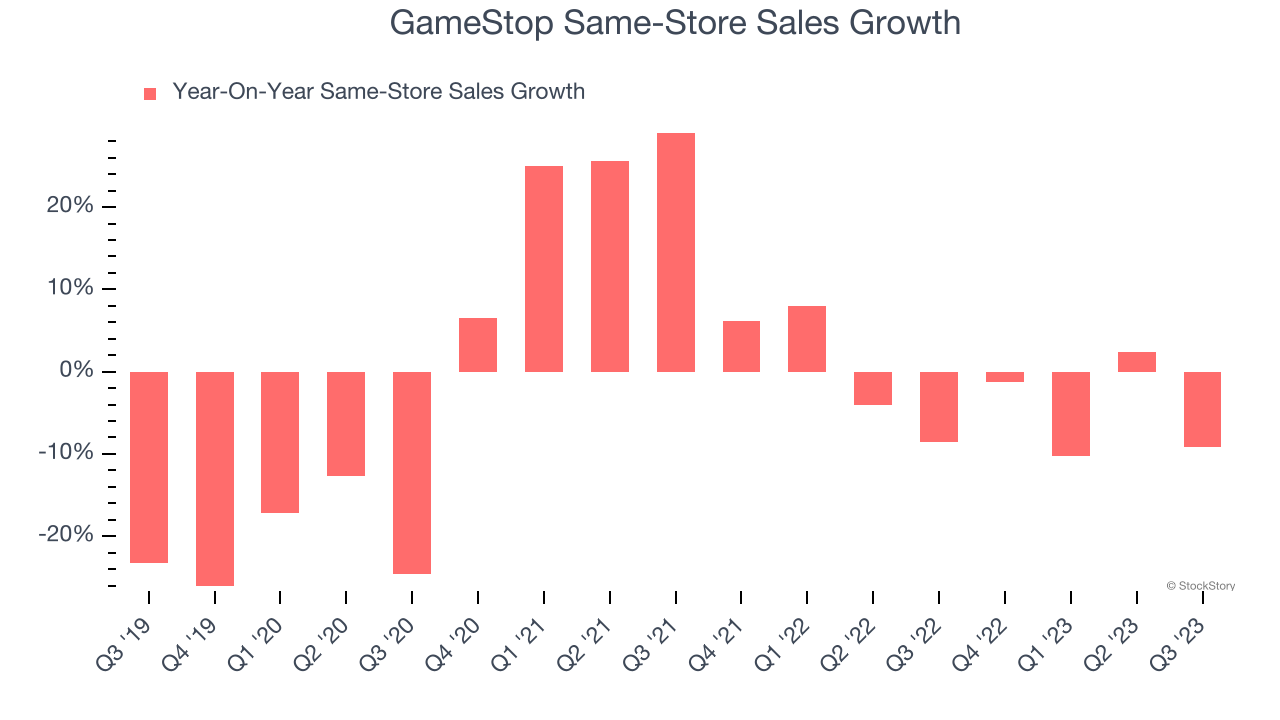

Same-store sales show the change in sales for a retailer's e-commerce platform and brick-and-mortar shops that have existed for at least a year. This is a key performance indicator because it measures organic growth.

GameStop’s demand has been shrinking over the last two years as its same-store sales have averaged 4.5% annual declines.

Note that GameStop reports its same-store sales intermittently, so some data points are missing in the chart below.

2. Breakeven Operating Raises Questions

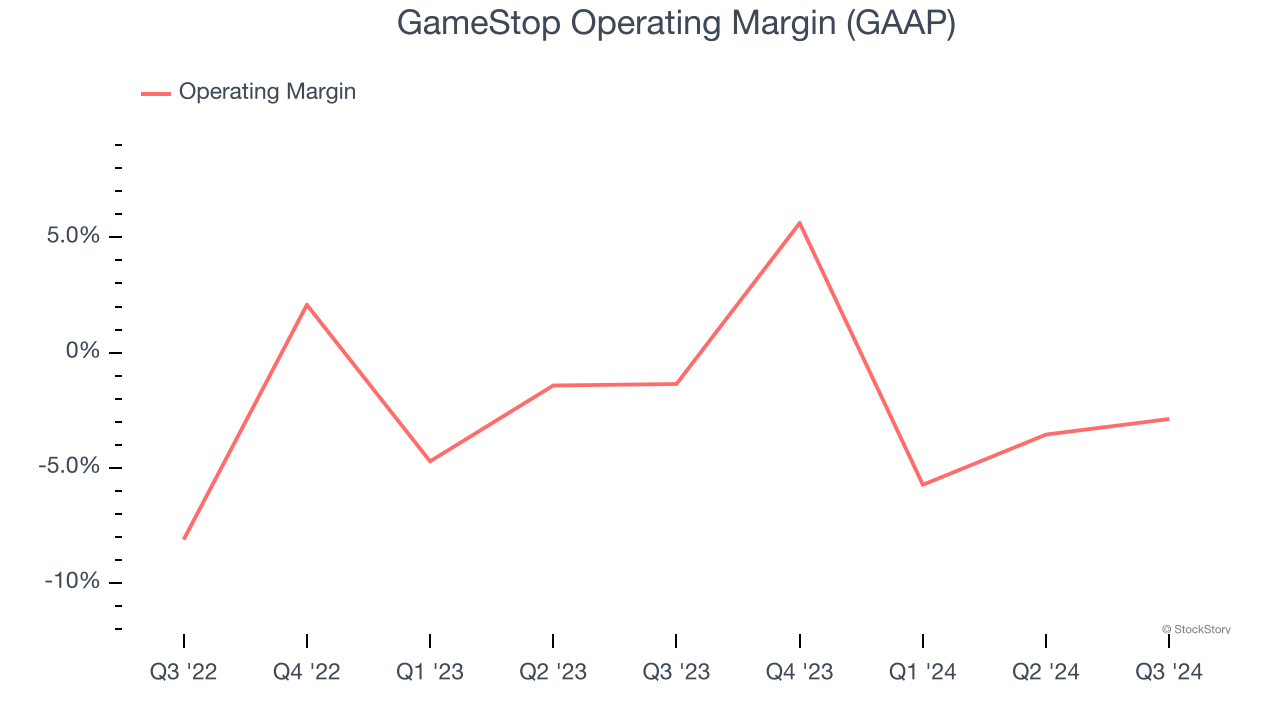

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses–everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

GameStop was roughly breakeven when averaging the last two years of quarterly operating profits, one of the worst outcomes in the consumer retail sector. This result isn’t too surprising given its low gross margin as a starting point.

3. Previous Growth Initiatives Have Lost Money

Growth gives us insight into a company’s long-term potential, but how capital-efficient was that growth? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

GameStop’s five-year average ROIC was negative 17.9%, meaning management lost money while trying to expand the business. Its returns were among the worst in the consumer retail sector.

Final Judgment

We cheer for all companies serving everyday consumers, but in the case of GameStop, we’ll be cheering from the sidelines. With its shares outperforming the market lately, the stock trades at $32.17 per share (or 3.8× forward price-to-sales). The market typically values companies like GameStop based on their anticipated profits for the next 12 months, but it expects the business to lose money. We also think the upside isn’t great compared to the potential downside here - there are more exciting stocks to buy. We’d recommend looking at Wabtec, a leading provider of locomotive services benefiting from an upgrade cycle.

Stocks We Would Buy Instead of GameStop

With rates dropping, inflation stabilizing, and the elections in the rearview mirror, all signs point to the start of a new bull run - and we’re laser-focused on finding the best stocks for this upcoming cycle.

Put yourself in the driver’s seat by checking out our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like Comfort Systems (+783% five-year return). Find your next big winner with StockStory today for free.